The question “Will lithium-ion battery prices increase in 2026?” matters to many people. It affects electric vehicle buyers. It affects energy storage companies. It also affects consumers who use power tools, laptops, and backup power systems. The lithium ion battery sits at the center of modern energy technology. Price changes will shape many industries in the years ahead.

What Determines Lithium-Ion Battery Prices?

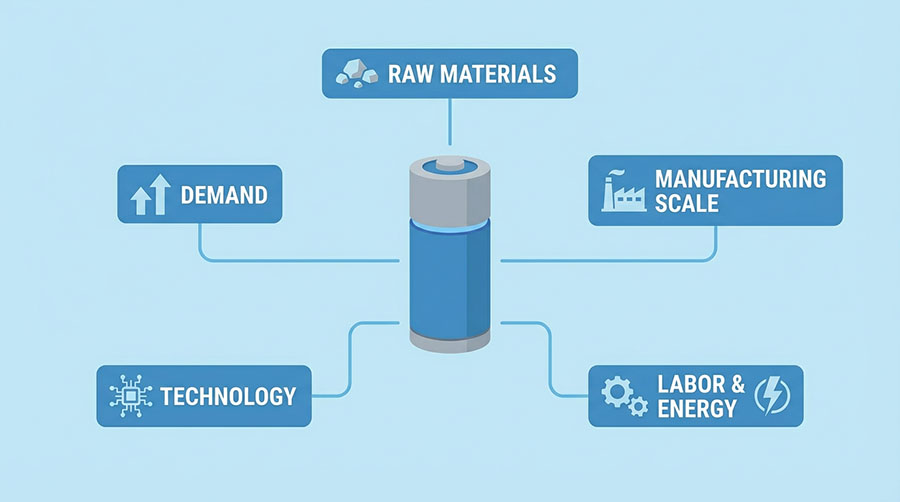

The price of a lithium ion battery depends on several major factors. These factors work together to shape costs across the global market.

First, raw materials play a key role. Lithium, nickel, cobalt, manganese, and graphite are essential for battery production. If the price of any of these rises, battery prices often follow.

Second, manufacturing scale affects cost. Large factories reduce unit prices through automation and volume production. Smaller plants usually operate at higher costs.

Third, labor and energy costs matter. Battery factories use large amounts of electricity. If energy prices rise, battery prices often increase as well.

Fourth, technology and design influence cost. New designs that reduce cobalt or improve energy density can lower prices over time.

Finally, global demand affects pricing power. When demand grows faster than supply, prices rise. When supply catches up, prices stabilize or fall.

A Look Back: Lithium-Ion Battery Price Trends (2015–2024)

Over the past decade, lithium ion battery prices have dropped sharply. In 2015, the average battery pack cost was over $1,000 per kilowatt-hour. By 2023, that price fell below $150 per kilowatt-hour in many markets.

This dramatic drop came from factory expansion, better chemistry, and improved supply chains. Electric vehicle adoption also pushed manufacturers to scale faster.

However, the price decline slowed between 2022 and 2024. Raw material shortages and geopolitical risks disrupted supply. Lithium prices surged in 2022, then corrected in 2023 and 2024. This created price volatility across the battery industry.

The key takeaway is simple. Long-term prices trend downward, but short-term spikes remain possible.

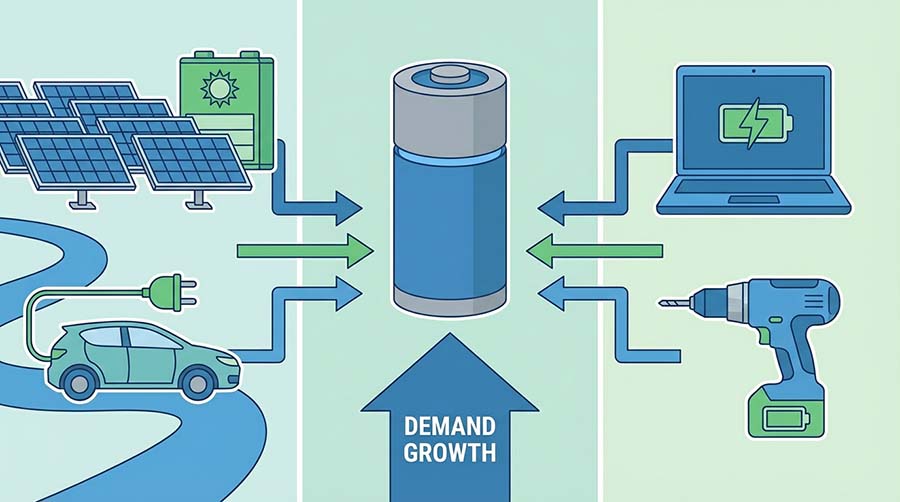

Global Demand Growth Will Continue Into 2026

Demand for the lithium ion battery will keep growing through 2026. This growth comes from three main sectors.

First, electric vehicles drive the largest share of demand. Automakers continue to release new EV models. Governments also set stricter emissions rules. These factors push EV adoption forward.

Second, renewable energy storage expands rapidly. Solar farms and wind farms need large battery systems for grid stability. These projects consume massive volumes of lithium-ion batteries.

Third, consumer electronics remain strong. Laptops, smartphones, drones, and power tools all rely on lithium-ion cells.

Because demand continues to rise across all major sectors, pressure on the supply chain will remain strong through 2026.

Will Raw Material Prices Push Battery Prices Higher?

Raw materials are the greatest risk for price increases. Lithium remains the most critical input for the lithium ion battery.

Lithium mining capacity expanded rapidly in Australia, South America, and China. New projects in Africa and North America also entered development. This expansion helped stabilize prices in 2024 and 2025.

However, demand still grows faster than new production in some years. Any delay in mining projects could lead to shortages again.

Nickel and cobalt also bring uncertainty. High-grade nickel is essential for high-energy EV batteries. Cobalt supply depends heavily on the Democratic Republic of Congo, which adds political risk.

If lithium or nickel prices rise sharply in 2026, battery prices could rise with them. If supplies remain balanced, prices may stay stable or decline slightly.

Manufacturing Expansion and Cost Reductions

Global investment in lithium ion battery manufacturing continues at record levels. Gigafactories in the United States, Europe, and Asia expand every year.

Large-scale production reduces per-unit costs. Robots handle more of the assembly process. Quality improves. Scrap rates fall. These improvements lower long-term prices.

New battery chemistries also reduce costs. Lithium iron phosphate (LFP) batteries use no cobalt or nickel. They cost less to produce and offer long cycle life. Many automakers now adopt LFP for standard-range vehicles.

If factory expansion continues on schedule through 2026, manufacturing efficiency will help offset raw material risks.

Government Policy and Its Impact on Prices

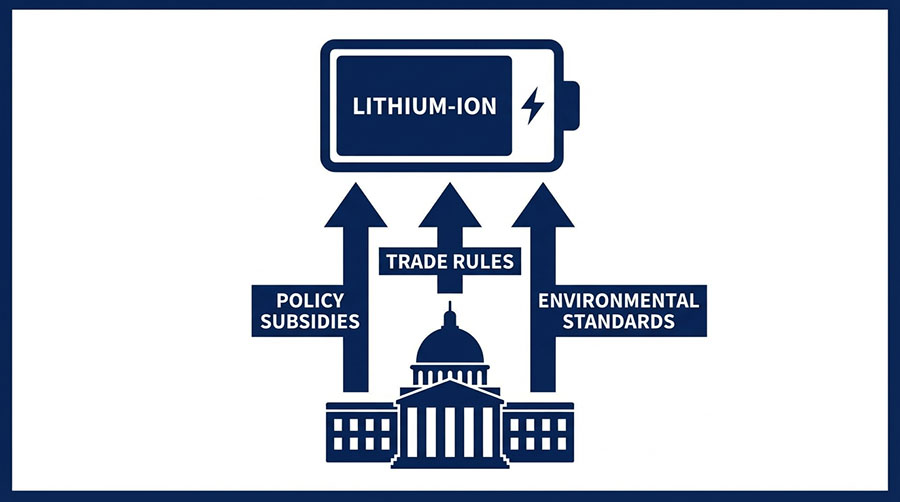

Government policy directly affects the lithium ion battery market. Tax credits, trade rules, and environmental standards all shape pricing.

In the United States, clean energy subsidies encourage domestic battery production. This reduces reliance on overseas supply chains. Domestic production tends to cost more at first, but it stabilizes prices long term.

In Europe, strict carbon regulations push automakers to electrify faster. This increases demand for batteries and puts upward pressure on prices.

Trade disputes also matter. Tariffs on battery components can increase import costs. Export restrictions on critical minerals could tighten supply.

In 2026, policy decisions will remain a major wild card for price movement.

Technology Innovation May Help Control Prices

Advances in lithium ion battery technology could slow future price increases.

Solid-state batteries promise higher energy density and lower fire risk. However, mass production remains several years away.

Silicon anode technology improves capacity and reduces charging time. It also increases production complexity in early stages.

Sodium-ion batteries offer a cheaper alternative for some applications. They reduce lithium dependency, but energy density remains lower.

In the short term, improvements mainly increase performance rather than reduce cost dramatically. Still, steady innovation helps control cost pressures.

What Do Industry Forecasts Say About 2026?

Most industry analysts agree on one key point. Lithium ion battery prices will not spike sharply in 2026 under normal conditions.

Many forecasts suggest modest price stability or a slight decline. This expectation depends on continued factory expansion and stable lithium supply.

However, analysts also warn of possible short-term volatility. Disruptions in mining, shipping delays, or sudden policy changes could cause temporary price increases.

The most realistic forecast for 2026 is this. Prices will remain within a narrow range, with small upward or downward swings depending on market conditions.

How Price Changes Affect Different Buyers

Price movements affect buyers in different ways depending on their use case.

Electric vehicle buyers care about battery pack prices more than cell prices. If pack prices rise, vehicle costs rise as well. This could slow EV adoption.

Energy storage companies watch long-term cost curves. They plan projects years in advance. Stable battery prices support large-scale grid deployments.

Industrial users value reliability and cycle life. Even if prices rise slightly, they still focus on total lifetime cost.

Consumer buyers feel price changes in laptops, power stations, and power tools. Small price increases may not stop demand, but they influence purchasing timing.

Should Businesses Lock in Battery Supply Before 2026?

Many companies ask the same question. Should they secure lithium ion battery contracts early?

Long-term contracts help protect against sudden price jumps. They also ensure stable supply for future projects.

However, long contracts lock buyers into fixed pricing. If prices fall further, buyers may miss savings.

The best strategy often involves mixed sourcing. Businesses secure part of their supply under long-term agreements. They leave the rest flexible to benefit from market changes.

This balanced approach reduces risk while keeping cost advantages.

HiMAX Lithium Ion Battery: A Reliable Choice for the Future

As the lithium ion battery market evolves toward 2026, choosing a stable and trustworthy supplier becomes more important than ever. HiMAX delivers high-performance lithium ion battery solutions designed for long service life, stable output, and strong safety protection.

HiMAX lithium ion batteries are widely used in energy storage systems, mobility applications, industrial equipment, and consumer electronics. Each battery undergoes strict quality testing for capacity, voltage consistency, and thermal stability. HiMAX also supports customized voltage, capacity, and battery pack design to match different project needs.

Whether you prepare for future price stability or protect against supply risk, HiMAX offers a dependable lithium ion battery solution built for performance, safety, and long-term value.

Find articles related to lithium ion batteries

- 48V Lithium-ion Battery Guide: Common Applications & Uses

- Boost Enterprise Efficiency & Reliability with 48V Li-ion Battery Systems

- 5 Key Factors When Sourcing Lithium-Ion Batteries

- Portable & Wearable Medical Devices: Why They Now Use Low-Voltage Li-ion Batteries

- Top Causes of Li-ion Battery Damage and How to Prevent It