Building a Sustainable Future Through Battery Recycling

As Li-ion battery deployment ramps up globally, responsible end-of-life management becomes a strategic priority. Recycling recovers critical materials (cobalt, nickel, lithium, copper, aluminum), reduces raw-material pressure and mitigates environmental risk. For OEMs, integrators and bulk buyers, understanding recycling pathways, regulatory requirements and supplier commitments is essential — not only for compliance but also to meet corporate sustainability goals and secure long-term raw material access.

This article explains the major recycling processes, key recovered materials for different chemistries, environmental benefits, and procurement practices that integrate circularity into supply chains.

The main battery recycling processes — technical overview

Three primary recycling approaches are used today:

Pyrometallurgical (smelting)

- Process: High-temperature smelting to recover metals like cobalt, nickel and copper.

- Strengths: Mature for mixed battery feedstock; robust industrial scale.

- Limitations: Low lithium recovery rates; energy intensive; emissions need control.

Hydrometallurgical (leaching)

- Process: Mechanical pre-treatment + chemical leaching to dissolve and selectively recover metals (nickel, cobalt, lithium).

- Strengths: Higher lithium recovery; selective extraction; scalable with improved environmental controls.

- Limitations: Requires chemical reagents and wastewater treatment.

Direct recycling / black mass refinement

- Process: Recover active materials (cathode powders) with minimal chemical transformation; aim to regenerate cathode precursors for reuse.

- Strengths: Potentially highest value recovery and lower processing energy; preserves active material structures.

- Limitations: Still under commercial scaling; feedstock purity and mixed chemistries complicate processes.

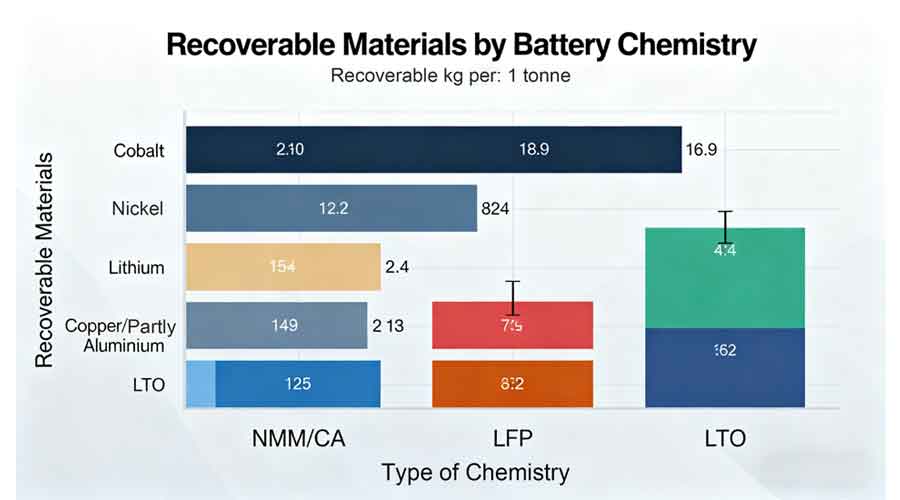

Recovered material profiles by chemistry

Different cell chemistries yield different valuable streams. The table below illustrates typical recoverable materials per 1 tonne of spent cells (approximate values for illustration).

| Chemistry (1 t spent cells) | Cobalt (kg) | Nickel (kg) | Lithium (kg) | Copper/Al (kg) | Notes |

| NMC / NCA | 20–80 | 60–200 | 10–20 | 150–250 | High cobalt/nickel value; strong hydromet routes |

| LFP | 0–5 | 0–10 | 10–25 | 150–250 | Lower high-value metals; lithium & iron recovery focus |

| LTO / other | 0–10 | 0–30 | 10–30 | 150–250 | Material mix matters for economics |

Note: Values vary widely with cell design, state of charge, and processing efficiency.

LFP chemistry, while safer and long-lived, yields less high-value cobalt/nickel; this changes the economic case for recycling and highlights the need for policy support or alternative value models (e.g., recovery of lithium, iron, copper, and aluminum, or second-life applications).

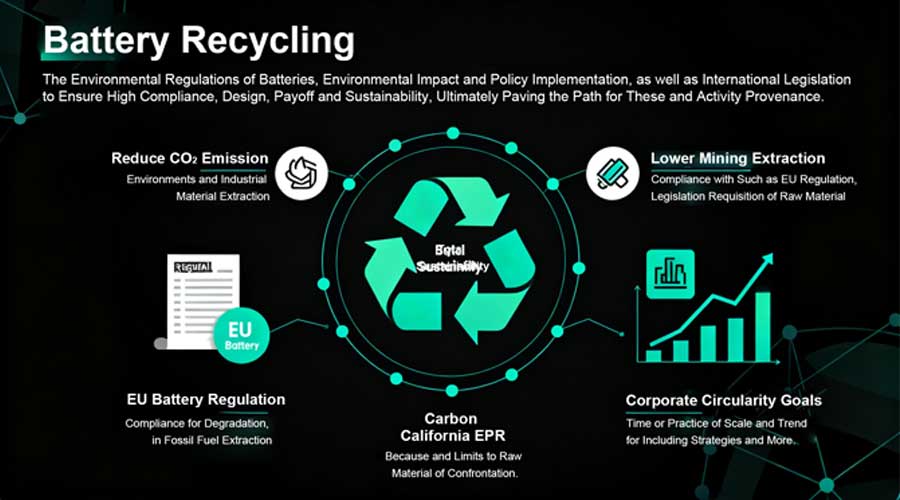

Environmental and regulatory context

- Regulations: Many regions (EU Battery Regulation, California EPR proposals, China battery recycling mandates) are tightening recycling obligations and setting collection and recovery targets.

- · Circularity goals: Corporate purchasers increasingly require suppliers to document end-of-life management and provide traceable material flows.

- Emissions & energy footprint: Hydrometallurgical and direct recycling routes can reduce CO₂ intensity vs primary mining, but lifecycle analysis depends on energy sourcing and process efficiency.

Practical recovery economics & incentives

Recycling economics depend on: material prices, process yields, logistics and scale. For chemistries with high nickel/cobalt content, metal revenues can offset process costs; for LFP, recycling value is lower and may require policy incentives or combined streams to be financially viable.

Example cost/revenue drivers

- Transport and disassembly costs per tonne.

- Yield of lithium recovery (kg recovered per tonne feedstock).

- Market price volatility for nickel/cobalt/lithium.

- Government subsidies or mandated takeback fees.

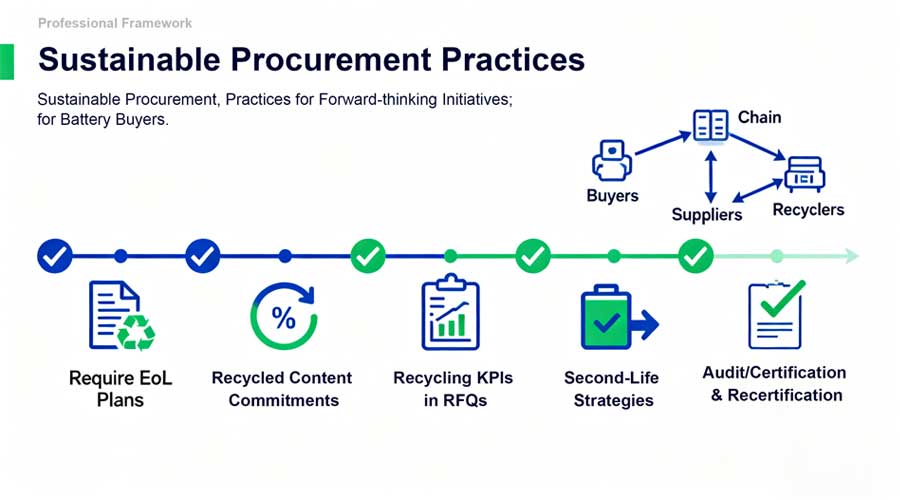

Recommended procurement & supply-chain practices for buyers

1. Require supplier EoL (End-of-Life) plans: Include return, collection and recycling routes in contracts.

2.Ask for recycled content commitments: Prefer suppliers who can incorporate recycled cobalt/nickel/lithium into new materials.

3.Include recycling KPIs in RFQs: Percent material recovery, documented chain of custody, and certified recycler partners.

4.Consider second-life strategies: For less degraded packs, second-life use (stationary storage) can delay recycling and improve lifecycle economics.

5.Audit and certification: Demand third-party verification of recycling partners and adherence to environmental standards.

How Himax Battery approaches sustainable manufacturing

Himax commits to a multi-pronged sustainability approach:

- Design for recyclability: Mechanical designs that simplify disassembly and enable safer cell extraction.

- Supplier partnerships: Working with certified recyclers and material refiners to ensure closed-loop material flows. (See: /custom-battery-design/)

- Second-life programs: Evaluating used packs for repurposing in less demanding stationary applications before recycling.

- Process transparency: Providing customers with recycling documentation and recovery metrics where available.

These practices reduce environmental footprint and help clients meet regulatory or corporate ESG targets.

Case study — integrating second-life and recycling in procurement

A utility procuring 10 MWh of battery capacity can:

1.Specify end-of-life return logistics with the supplier.

2.Set contract clauses that a percentage of recovered lithium/copper will be returned as credits or used in new orders.

3.Pilot second-life use for de-rated packs in community storage projects, extending useful life and deferring recycling costs.

This model aligns environmental goals with economic outcomes.

Conclusion — circularity is a procurement requirement, not an optional extra

As battery volumes grow, recycling and circular supply-chain practices will become baseline expectations for bulk buyers and OEMs. Choosing suppliers who can demonstrate end-of-life plans, recycled material incorporation, and second-life pathways reduces regulatory risk and protects long-term material access.

CTA: If you want to include recycling and second-life commitments in your RFQ, or need supplier documentation templates, contact Himax Battery at services@himaxelectronics.com or visit himaxbattery.com/contact. Himax can collaborate on design-for-recycling, second-life assessment and certified recycling partnerships to help you meet sustainability and compliance goals.

Find articles related to li-ion batteries